Wills and Estates are core business and not a sideline for our firm. For more information, please call us on 08 8278 1779

We believe a Will is the most important document a person will ever sign, given that it is probably the only document you will ever sign that gives away everything you own. There are many important documents throughout our lives that we sign. You may buy and sell your home, shares, businesses and the like, however these are generally isolated transactions. Arguably the Will is therefore the largest “transaction” anyone will ever do. Accordingly, we believe it should be done properly and professionally.

We provide timely, pragmatic and cost-effective legal advice for all life planning and estate planning matters including:

- Wills

- Powers including Enduring Power of Attorney and Advanced Care Directives

- Deceased Estates

We make doing your Will painless and a satisfying process. While most people want a “basic Will”, we also cater for people with complicated family situations, estranged children, disabled children that need protective trusts and blended families. All these situations are well understood and we have a wealth of experience in drafting a Will that will suit your particular needs.

Standard Wills using our Online Will questionnaire

We charge a reduced fixed fee for a Standard Will if your family and asset circumstances are uncomplicated. In uncomplicated circumstances we are primarily offering a professional service to draft your Wills.

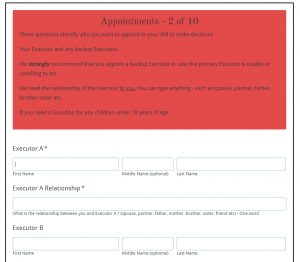

For Standard Wills we request that you give us the majority of your instructions and details via an online Will with a web-based questionnaire.

One of our lawyers will then call you to confirm any missing details and ensure that everything was clear. We then provide the draft to you by email ahead of you coming in to sign the final document. Our usual turn around time for standard Wills is two weeks – although we can expedite this in the event of illness or emergency. Please contact us to get the link to the online Will questionnaire.

This process has been successfully used by many clients who enjoy its convenience and time saving advantages. Clients can at any time change their mind and still come in to see us in person. The choice is yours.

Non-Standard, Estate Planned Wills

We also recognise that not everyone’s circumstances are straightforward. If your situation includes any of the following circumstances then we advise that you will benefit from a personal, face to face consultation with our lawyers before we begin to draft your Will. If you wish, we will engage with your financial planner in order to assist you in achieving your estate planning objectives either to protect assets, minimise taxation* or simply to ensure that the benefit of your estate goes where you intend.

Estate planning is not just Will drafting. Estate Planning is the planning and documentation of the wishes of a person for the management of all assets under the control of that person during their lifetime and the distribution of all assets under the control of that person in the event of his or her death to ensure a smooth and tax effective passing of assets to his or her chosen beneficiaries.

However, if your situation includes any of the following four complex circumstances then we advise that a Standard Will is unlikely to be suitable. Please call us before proceeding on 8278 1779

- Blended families or second marriages

- Caring for other people’s children

- Life interests and Rights of Residency

- Conditional gifts

- Family Trusts

- Discretionary Testamentary Trust requirements (includes protective Trusts for disabled children)

If your situation includes any of the following circumstances, you will benefit from a personal, face to face consultation, either online or in person with our lawyers before we begin to draft your Will, but a Standard Will is likely to still be suitable.

- Business Owners – re continuity planning

- Overseas or interstate assets

- Large asset pools

- Self Managed Super Fund (SMSF)

- Binding Death Nomination in place

- Existing Family Court Orders or a Binding Financial Agreement

- Exclusion of children or other beneficiaries (children with marital or domestic partner problems)

- Conditional appointments of Guardians

- Non-standard gifts

Our costs for a non-standard Estate Planned Will therefore vary above the baseline fee depending to what extent the above circumstances need to be considered and incorporated into your Will. If the taking of your instructions is protracted beyond an hour or if we need to do extensive additional drafting – such as in the case of inserting a discretionary testamentary Trust as advised by your accountant for taxation purposes, then we charge according to the Supreme Court Scale.

* In all cases, there will be no specific tax advice or other advice given to consider restructuring assets to best suit a tax outcome. In all cases the client should obtain their own independent taxation advice.

Enduring Power of Attorney

An Enduring Power of Attorney allows you to nominate the person you want to take care of your finances and affairs in the event that you are unable to. We advise that all small business owners have this in place to ensure business continuity. For families, while it is presumed to be the spouse, you may not want that for a variety of reasons. Further, we always advise that a backup attorney be appointed.

Advanced Care Directives

If you were unable to speak for yourself, who would you want to speak for you? And more importantly, what health care decisions would you want them to make? A professionally drafted Advanced Care Directive will give you that voice and allow you to be heard in the event of a medical incident.

Probate

Also part of our Wills and Estates practice is assisting executors with obtaining a Grant of Probate for a Deceased Estate. This can can be a daunting task that most people only ever do once in their life. It is technically complex and the Probate Registry will not give advice. Most executors will therefore engage a lawyer to assist with the application process and possibly also with the post-Grant distribution process.

For more information, please refer to our Probate page or call us on 08 8278 1779